At a glance

Overview

CDC expects the fall and winter respiratory disease season will likely have a similar or lower number of combined peak hospitalizations due to COVID-19, influenza, and RSV compared to last season. This assessment has not changed since CDC's outlook was initially published on August 29, 2024. CDC's COVID-19 scenario modeling indicates that if a novel SARS-CoV-2 variant with immune escape properties does not emerge, the peak burden will likely be lower than last season and occur in late December or early January.

As of December 13, overall respiratory virus activity is moderate nationally. The Respiratory Illnesses Data Channel has weekly updates about current surveillance trends for respiratory illnesses.

- COVID-19: COVID-19 activity is beginning to increase from low levels in some areas of the nation. COVID-19-associated emergency department (ED) visits and hospitalizations remain at low levels. Laboratory percent positivity is 5.4% (as of December 7). Epidemic trend estimates indicate that COVID-19 infections are growing or likely growing in much of the country, as of December 10. CDC estimates that from October 1 through November 30, 2024, there have been between 64,000 and 110,000 hospitalizations due to COVID-19.

- Influenza: Nationally, seasonal influenza activity continues to increase across the country. As of December 10, epidemic trend estimates indicate that influenza virus infections are growing or likely growing in 39 states, declining or likely declining in 0 states, and not changing in 2 states.

- RSV: Nationally, RSV activity is moderate and continues to increase in most areas of the United States, particularly in young children. See the RSV Forecast Hub for forecasts of RSV hospital admissions for the United States. CDC estimates that from October 1 through November 30, 2024, there have been between 17,000 and 34,000 hospitalizations due to RSV.

This outlook is intended to provide health officials and decision-makers with information to assist in public health preparedness during the 2024-2025 fall and winter respiratory virus season, such as when hospitals might consider preparing for the highest demand.

Our assessments are based on expert opinion, current and historical surveillance data, and scenario modeling for COVID-19, influenza, and RSV. As with all long-range scenarios, there is inherent uncertainty, which we describe below.

Timing of peak hospital demand this season

In our initial 2024-2025 outlook, published on August 29, we outlined two potential scenarios for COVID-19 hospitalization burden to demonstrate the range of possibilities for how the season could unfold. We continue to assess surveillance data and use scenario modeling to consider key factors that could drive the rest of the fall and winter respiratory season. One factor is the timing of peak hospital demand from COVID-19, influenza, and RSV.

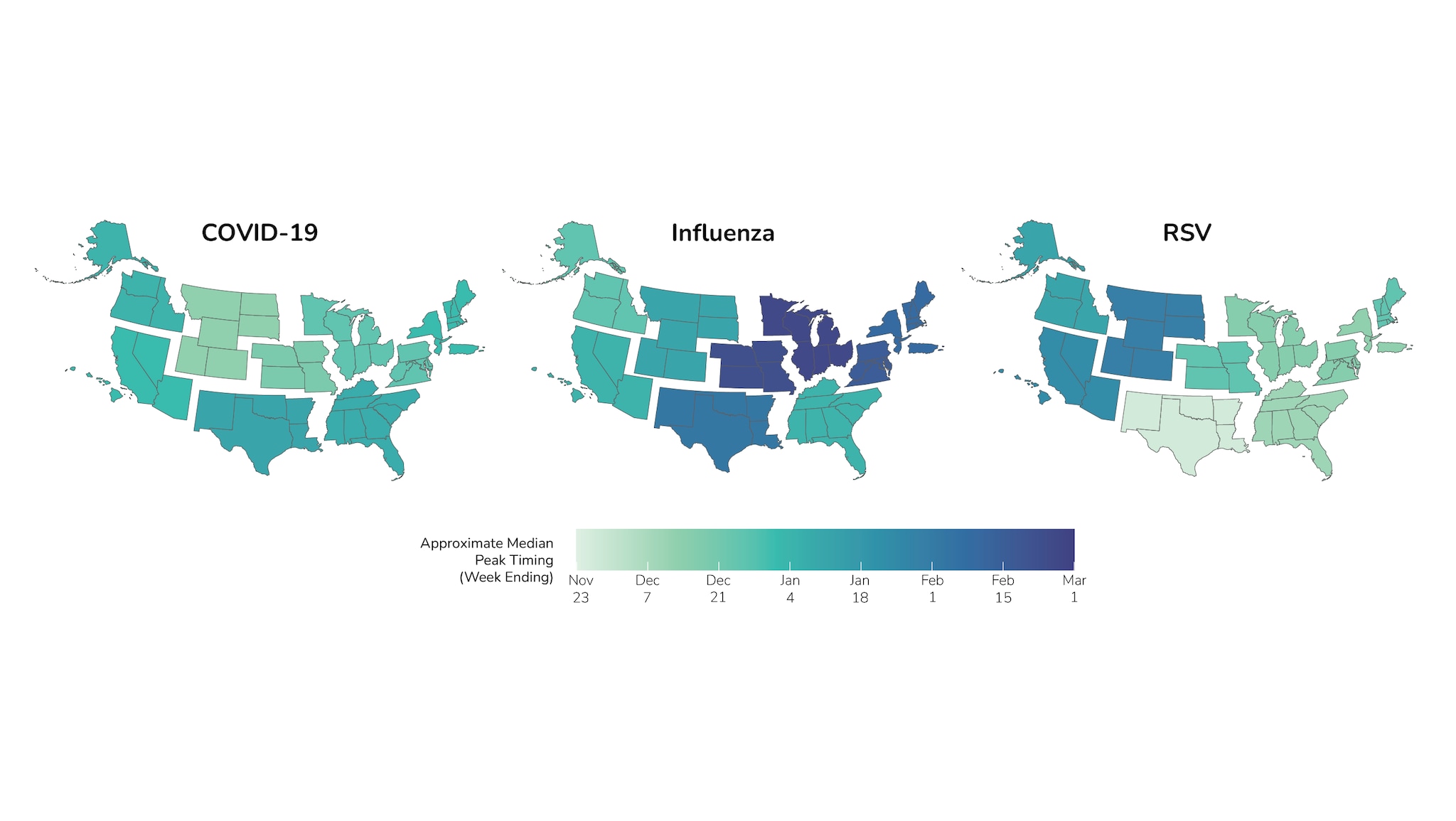

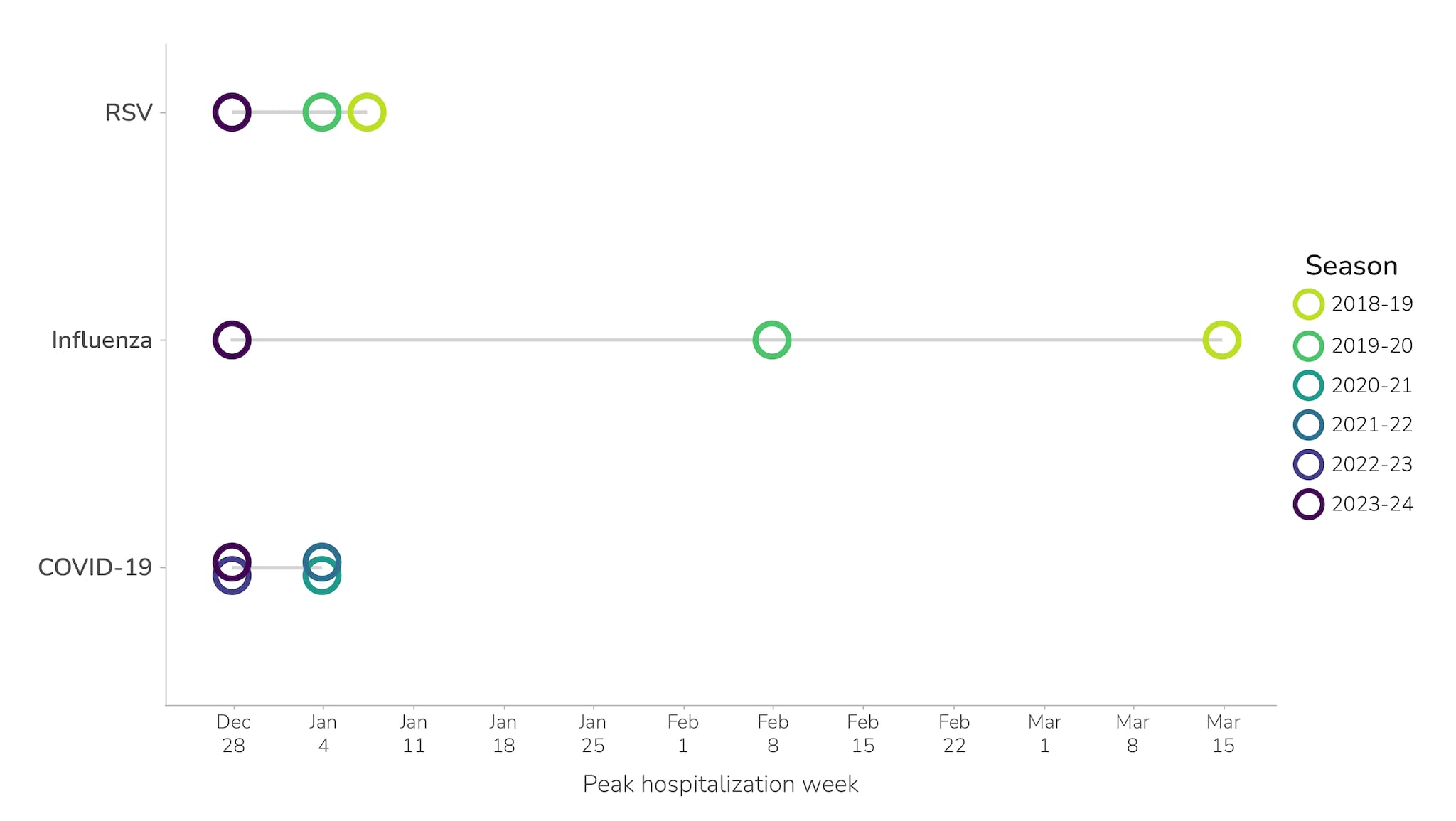

To assess when peak hospital demand may occur this season, historical data on COVID-19, influenza, and RSV provide some insights and a baseline for what to expect. Past data show substantial variation in the timing of seasonal peaks by region (Figure 1) and across seasons (Figure 2).

- The median peak of COVID-19 winter waves, based on test positivity, across the last four fall and winter respiratory seasons has been in December or January for all HHS regions. As of December 19, 2024, COVID-19 surveillance data indicates that the winter wave is beginning later than in past seasons, which could indicate that the COVID-19 season peak will occur later this season.

- Influenza seasons typically peak between December and February, but timing within this range is less predictable.

- The RSV season peaks have historically varied by region, with the Southeastern region peaking earlier than Northern and Western regions.

The national combined peak hospitalization burden for COVID-19, influenza, and RSV depends, in part, on whether peaks occur during the same week—which occurred during the 2023-2024 respiratory virus season. Based on historical trends (Figure 2), concurrent peaks of COVID-19 and RSV in multiple regions are likely in the future. However, influenza frequently peaks later in the respiratory season, and historical trends indicate that concurrent peaks of all three viruses are less likely to occur. If the individual peaks for COVID-19, influenza, and RSV are not concurrent, the combined peak hospitalization burden may be lower than in recent years, though this depends on the magnitude of the peak for each disease; historically, the peaks for COVID-19 and influenza have been much higher than for RSV.

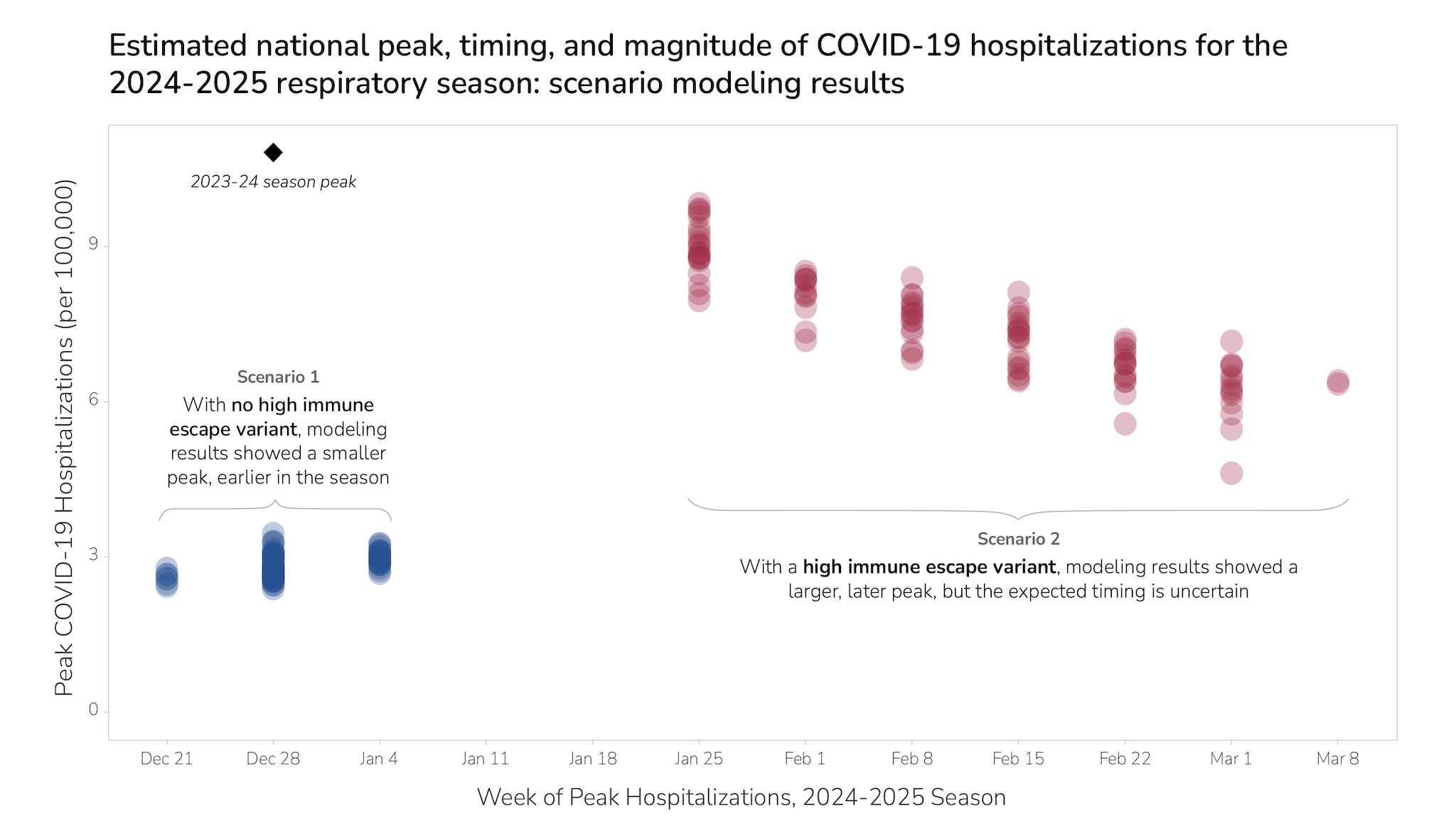

In addition to historical data, we used CDC's COVID-19 scenario model to assess when the COVID-19 winter peak might likely occur this season. Scenario modeling helps explore what might happen by changing inputs and assumptions in the model. One key uncertainty about the timing and magnitude of the COVID-19 winter peak is whether a new variant with immune escape properties will emerge, similar to the JN.1 variant that emerged during the 2023-2024 respiratory virus season. Based on the historical timing of major variants emerging, in our initial outlook from August and our update in October, we assumed such a variant would emerge by November. However, a major new variant has not yet emerged. We therefore modeled two scenarios for how the rest of the season could unfold to assess the impact of variants on peak timing and magnitude: 1) no new immune escape variant (Scenario 1), and 2) the introduction of a new variant in December, with a high level of immune escape (Scenario 2). Our baseline assumption regarding vaccinations in both scenarios is that uptake rates through the end of the season will match last season. However, because uptake to date has been somewhat higher than last season, this means we assume uptake over the entire season will also be somewhat higher.

We detail two potential scenarios for both the regional and national levels. In the absence of a major new immune-escape variant (Scenario 1), results based on CDC's COVID-19 scenario model show that substantial winter waves are either not expected or are expected to be much smaller than the wave from this past summer. The model shows these waves occurring in December or January, similar to the timing of the peaks in the past two seasons (Figure 3).

If there is a new immune-escape variant (Scenario 2), substantial waves are expected with peaks occurring later than last winter, nationally and in all individual regions. This later, more variable timing is due to the length of time it could take for a newly emerging variant to spread.

Nationally, even following the introduction of a new high-immune-escape variant, modeling suggests the magnitude of the peak will be similar to or smaller than last season's peak (Figure 3). Regionally, the magnitude of the peak varies—with some regions having smaller peaks than last season (regions 2, 5, 8); some having either smaller or comparable peaks (regions 1, 3, 7, 9, 10); and some having comparable or higher peaks (regions 4, 6)A. This variation is due to several factors, including differences in the size of recent waves and the strength of seasonal drivers by region.

While we model two scenarios, we note that outcomes with intermediate magnitude are also possible: If existing variants mutate to have a somewhat higher level of immune escape than they do currently, we could observe a late winter wave with a peak height that falls between Scenarios 1 and 2.

Role of vaccination

Vaccination is expected to play a critical role in preventing hospitalizations due to COVID-19, influenza, and RSV this season. Vaccination coverage and sentiment vary by jurisdiction, age, race and ethnicity, poverty status, health insurance, and other social and demographic factors.

- COVID-19: As of December 7, 21.0% of adults 18 years or older and 44.5% of adults 65 years or older have received the updated 2024-2025 COVID-19 vaccine. Vaccination uptake is higher this year than at this time last year for adults 18 years or older (16.2%, as of December 2, 2023) and for adults 65 years or older (29.2%, as of December 2, 2023). Higher levels of vaccination could decrease the hospitalization burden due to COVID-19 this season.

- Influenza: As of December 7, 40.8% of adults 18 years or older have received the 2024-25 seasonal influenza vaccine, which is similar to uptake at the same time in the 2023-2024 season. During the 2023-2024 season, CDC estimates that influenza vaccination prevented 120,000 influenza-related hospitalizations.

- RSV: As of December 7, 42.5% of adults 75 years or older have received the RSV vaccine since it was first available last season, while an additional 7.3% indicate that they definitely will receive the RSV vaccine this year. Recent results from the RSV Scenario Modeling Hub indicated that approximately 29,000 seasonal RSV hospitalizations could be averted in a scenario where the RSV vaccine for seniors wanes slowly and infant interventions were introduced earlier in the season.

We used scenario modeling to understand the potential impact of COVID-19 vaccinations in the no-new-variant scenario (Scenario 1) and the scenario with introduction of a new variant with high immune escape (Scenario 2). Our model suggests that between 108,000 and 131,000 hospitalizations would be prevented by vaccinations this season in Scenario 1, and that between 155,000 and 191,000 hospitalizations would be prevented this season in Scenario 2, depending on how vaccine uptake for the remainder of the season compares to last year.B

Factors, Key Uncertainties, & Methods

While we expect this season's peak hospitalization rate will be similar to or lower than last year, there is still a risk of a higher peak rate, underscoring the need to consider this possibility in planning and preparedness activities. The following factors could drive higher peak rate:

- Emergence of a new COVID-19 variant with an increased ability to evade the body's prior immunity, or a new COVID-19 variant associated with higher clinical severity.

- Predominance of an influenza subtype with more severe outcomes.

- Lower vaccine uptake or effectiveness, including:

- If there is lower than projected uptake of the COVID-19 vaccine, influenza seasonal vaccine, or RSV vaccines and immunizations.

- If the updated 2024-2025 COVID-19 vaccine effectiveness against hospitalization is lower than that of the 2023-2024 vaccine.

- If influenza seasonal vaccine effectiveness against hospitalization is lower than projected.

- If there is lower than projected uptake of the COVID-19 vaccine, influenza seasonal vaccine, or RSV vaccines and immunizations.

This outlook is a high-level assessment intended to provide scenarios for how the 2024-2025 respiratory season could unfold; it is not a precise forecast. We have noted several areas of uncertainty for specific diseases in sections above, including related to vaccination and circulating viral variants and subtypes. Additional uncertainties include the following:

- It is difficult to predict the size and timing of peak activity for each disease, as well as how the timing might overlap. Experts agree that some level of overlap in peak hospitalization burden may occur. These factors will affect the level of demand on the healthcare system. We note that while peak hospitalization rate is a key factor, cumulative burden can also impact hospital demand throughout the season.

- The virus that causes COVID-19 is constantly changing, and a new variant could emerge that is less effectively mitigated by immunity from past infections or from existing vaccines and treatments. COVID-19 occurs at meaningful levels throughout the year with periodic epidemics, which can vary in timing and magnitude.

- Avian influenza A (H5N1) is widespread in wild birds worldwide and is causing outbreaks in poultry and U.S. dairy cows, with several recent human cases in U.S. dairy and poultry workers. While the current public health risk is low, CDC is watching the situation carefully and working with states to monitor people with animal exposures.

- Particularly for RSV, estimates are less precise for the burden of illnesses and hospitalizations in past seasons which limits our ability to anticipate trends for this respiratory season. Immunization uptake is also less certain because RSV immunization for older adults, for pregnant people, and for infants and young children were recommended last year for the first time.

The outlook and this update are based on expert opinion, current and historical surveillance data, and scenario modeling for COVID-19, influenza, and RSV.

Our Behind the Model article features more detail on our modeling methods.

- Regional offices: Region 2 (New York), Region 5 (Chicago), Region 8 (Denver), Region 9 (San Francisco); Region 1 (Boston), Region 3 (Philadelphia), Region 7 (Kansas City); Region 4 (Atlanta), Region 6 (Dallas), Region 10 (Seattle)

- Scenario modeling assumes 75% vaccine efficacy against hospitalization; uptake for the remainder of the season ranges from 50% lower than last season to 50% higher than last season.