|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

||||

| ||||||||||

|

|

|

|

|

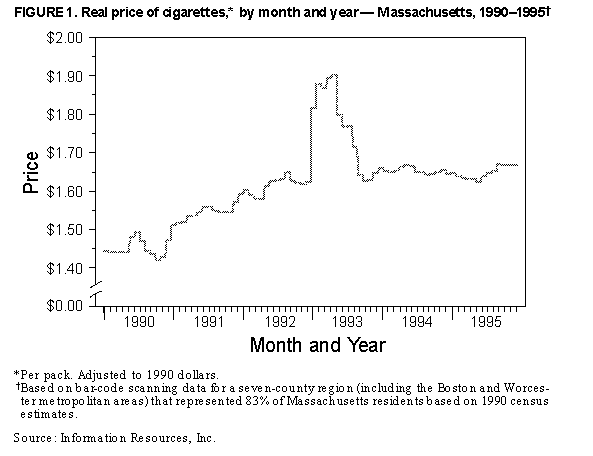

Persons using assistive technology might not be able to fully access information in this file. For assistance, please send e-mail to: [email protected]. Type 508 Accommodation and the title of the report in the subject line of e-mail. Cigarette Smoking Before and After an Excise Tax Increase and an Antismoking Campaign -- Massachusetts, 1990-1996In November 1992, residents of Massachusetts approved a ballot petition (Question 1) that increased the tax on each pack of cigarettes from 26[ to 51[ beginning January 1, 1993, and requested that the legislature spend the proceeds on tobacco control and health education. The Massachusetts Tobacco Control Program (MTCP), administered by the Massachusetts Department of Public Health (MDPH), was established in response to the approval of the petition. In October 1993, MTCP initiated a statewide mass-media antismoking campaign. In early 1994, the program began funding local boards of health and school health and other youth programs to promote policies to reduce public exposure to environmental tobacco smoke and to restrict youth access to cigarettes. Efforts also included support to health education programs, primary-care providers, and other services to help smokers quit. Through June 1996, MTCP expenditures totaled $116 million, including $43 million for the mass-media campaign (1). To assess the effects of the excise tax increase and the antismoking campaign on cigarette smoking in Massachusetts, CDC and MDPH analyzed data about the number of packs of cigarettes taxed per capita and the prevalence of cigarette smoking during the period preceding (1990-1992) and following (1993-1996) implementation of the ballot petition. This report summarizes the findings of the assessment and compares trends in cigarette consumption (i.e., purchases) in Massachusetts, in California (where a voter-mandated cigarette tax increase in January 1989 funded a statewide antismoking campaign that began in April 1990 {2}), and in the 48 remaining states and the District of Columbia combined. The findings suggest that the number of packs of cigarettes taxed per capita declined substantially in Massachusetts after implementation of the ballot petition. For each full calendar year from 1990 through 1995, taxable cigarette consumption for Massachusetts, California, and the other states and the District of Columbia combined was derived from monthly reports from the Tobacco Institute on tax receipts for wholesale cigarette deliveries (3). Taxable consumption for 1996 was estimated as twice the cumulative values for January-June. Per capita rates (in packs/year) were based on the resident population aged greater than or equal to 18 years in each state (4). Data on the average retail price of a pack of cigarettes in Massachusetts at 4-week intervals during 1990-1995 were based on bar-code scanning data provided by Information Resources, Inc. (5). Data were obtained for a seven-county region (including the Boston and Worcester metropolitan areas) that represented 83% of Massachusetts residents based on 1990 census estimates. The observed retail prices of cigarettes were adjusted for inflation by using the consumer price index for urban workers in the Boston metropolitan area (6). Data from the Behavioral Risk Factor Surveillance System (BRFSS) for 1990 through 1995 (the most recent year for which data were available) were used to estimate the annual prevalence of cigarette smoking among adults in Massachusetts, California, and the remaining participating states combined. The BRFSS is a population-based, random-digit-dialed telephone survey of the noninstitutionalized U.S. population aged greater than or equal to 18 years. The District of Columbia and seven states (Alaska, Arizona, Kansas, Nevada, New Jersey, Rhode Island, and Wyoming) were excluded because they did not participate in BRFSS 1 or more years during 1990-1995 (7; CDC, unpublished data, 1995). Because sampling errors for annual BRFSS estimates precluded precise year-to-year comparisons, 3-year average prevalences were estimated for 1990-1992 and 1993-1995. A current smoker was defined as any respondent who answered "yes" to the following two questions: "Have you smoked at least 100 cigarettes in your entire life?" and "Do you smoke cigarettes now?" Estimates were weighted based on the number of telephones per household and the age, sex, and racial/ethnic composition of the residents of the individual states. The prevalence of smoking for the remaining participating states combined was computed as a population-weighted average of the prevalences estimated for the 41 states that participated in BRFSS every year during 1990-1995. SESUDAAN was used to calculate 95% confidence intervals (CIs). During 1990-1992, taxable per capita consumption of cigarettes by adults declined 6.4% in Massachusetts, 11.0% in California, and 5.8% in the 48 remaining states and the District of Columbia combined (Table_1). In Massachusetts, from 1992 (the year before implementation of the petition) to 1996, taxable per capita consumption declined by 19.7% (from 117 packs to 94 packs) (Table_1); in California and the remaining states, per capita consumption declined by 15.8% and 6.1%, respectively. Immediately after the Massachusetts petition became effective on January 1, 1993, the real price of cigarettes increased sharply but subsequently declined (Figure_1). In response to increasing sales of discount brands, in April 1993 one U.S. cigarette manufacturer announced a nationwide, 40[-per-pack price discount on its major premium brand, and in May, another manufacturer matched the discount on its major premium brands. In August, all manufacturers announced a permanent wholesale price reduction of 39[ per pack on all premium-brand cigarettes (8). As a result of these nationwide price reductions, by the end of October the real price of cigarettes in Massachusetts had declined to the 1992 level (Figure_1). The prevalence of current smoking among adults in Massachusetts was 23.5% (95% CI= plus or minus 1.4%) during the 3 years before implementation of the petition (1990-1992) and 21.3% (95% CI= plus or minus 1.2%) during the 3 years after implementation (1993-1995). In comparison, the prevalence of adult smoking declined 2.7% in California (from 20.1% {95% CI= plus or minus 0.9%} during 1990-1992 to 17.4% {95% CI= plus or minus 0.9%} during 1993-1995) and 0.8% in the 41 other BRFSS participating states combined (from 24.1% {95% CI= plus or minus 0.3%} during 1990-1992 to 23.4% {95% CI= plus or minus 0.2%} during 1993-1995). Reported by: JE Harris, MD, Massachusetts General Hospital, and Massachusetts Institute of Technology, Boston; GN Connolly, DMD, D Brooks, MPH, Massachusetts Dept of Public Health. B Davis, PhD, California State Dept of Health Svcs. Epidemiology Br, Office on Smoking and Health, National Center for Chronic Disease Prevention and Health Promotion, CDC. Editorial NoteEditorial Note: The findings in this report indicate that, in Massachusetts, the number of packs of cigarettes taxed per capita decreased significantly during 1992-1996, following implementation of a ballot petition to increase the excise tax on cigarettes and initiate an antismoking campaign. This change was similar to decreases in California (9), the only other state to have initiated an extensive statewide antismoking campaign in conjunction with an increase in cigarette taxes. However, complexities related to the accurate measurement of changes in smoking prevalence among adults in Massachusetts require further study to determine the combined impact of the excise tax increase and antismoking campaign on adult smoking prevalence in the state. Although some smokers in states that implement increased cigarette excise taxes may attempt to avoid higher prices by purchasing cigarettes in neighboring states with lower prices, the 19.7% decline in per capita consumption of cigarettes in Massachusetts during 1992-1996 probably reflects the effects of the tax increase and anti-smoking campaign rather than increased cross-border purchases by Massachusetts smokers. During 1993-1994, cigarette excise taxes in Connecticut and Rhode Island were increased to levels comparable with those in Massachusetts; however, in New Hampshire, the real price of cigarettes declined during 1992-1993, and taxable cigarette consumption increased by 17 million packs (3). Increased taxable consumption in New Hampshire may reflect either a real upward trend in smoking by state residents or increased cross-border purchases by Massachusetts smokers. However, even if the 17 million-pack increase were attributed entirely to cross-border purchases by Massachusetts smokers, the decline in per capita consumption in Massachusetts during 1992-1996 would have been reduced to 17.0%. The findings in this report are subject to at least two limitations. First, the estimates of per capita consumption were based on tax receipts at the wholesale level and not the actual number of cigarettes consumed. Distributors may delay or advance cigarette shipments in anticipation of announced wholesale price changes or excise tax increases. Such shifting of wholesale deliveries may produce year-to-year changes in tax receipts that do not reflect actual changes in per capita consumption. However, temporal trends in taxable consumption over a period of several years probably reflect actual consumption more accurately. Second, a decline in the number of cigarettes taxed in a single state may result in an overestimation of the actual decline in consumption if resident smokers increase their out-of-state purchases. However, the data on taxable per capita cigarette consumption in Massachusetts and three adjacent states suggest the increased purchase of cigarettes by Massachusetts smokers in neighboring New Hampshire was not a major source of the reported decline in per capita consumption in Massachusetts. Increases in the price of cigarettes can reduce per capita consumption and the prevalence of smoking (10). In Massachusetts, however, the tax-induced increase in cigarette price was soon offset by coincidental national, industrywide price reductions that began during the spring of 1993. While real cigarette prices returned to pre-1993 levels, per capita consumption in Massachusetts continued to decline. This finding suggests that a tax increase combined with an antismoking campaign can be more effective in reducing per capita consumption than a tax increase alone. MTCP plans additional evaluations of this preliminary finding, including changes in smoking prevalence among adults and further comparisons with findings from California and other states. References

Table_1 Note: To print large tables and graphs users may have to change their printer settings to landscape and use a small font size.

TABLE 1. Number of packs of cigarettes purchased per adult, * by year

-- selected U.S. sites, 1990-1996 +

================================================================================

Year Massachusetts California 48 Remaining states and the

District of Columbia

--------------------------------------------------------------------------------

1990 125 100 139

1991 120 92 134

1992 117 89 131

1993 102 88 125

1994 101 73 127

1995 98 76 125

1996 & 94 75 123

--------------------------------------------------------------------------------

* Aged =18 years.

+ Based on reports of tax receipts for wholesale cigarette deliveries.

& Estimated as twice the cumulative values for January-June.

================================================================================

Return to top. Figure_1  Return to top. Disclaimer All MMWR HTML versions of articles are electronic conversions from ASCII text into HTML. This conversion may have resulted in character translation or format errors in the HTML version. Users should not rely on this HTML document, but are referred to the electronic PDF version and/or the original MMWR paper copy for the official text, figures, and tables. An original paper copy of this issue can be obtained from the Superintendent of Documents, U.S. Government Printing Office (GPO), Washington, DC 20402-9371; telephone: (202) 512-1800. Contact GPO for current prices. **Questions or messages regarding errors in formatting should be addressed to [email protected].Page converted: 09/19/98 |

|||||||||

This page last reviewed 5/2/01

|