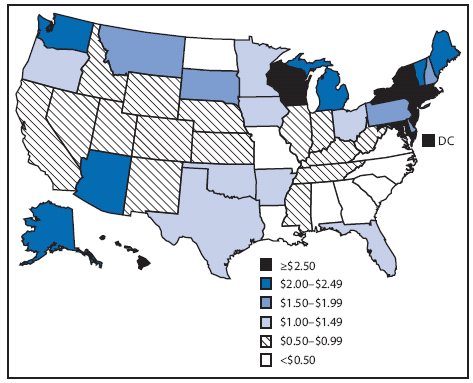

FIGURE 1. State excise tax per pack of 20 cigarettes --- United States, December 31, 2009

Persons using assistive technology might not be able to fully access information in this file. For assistance, please send e-mail to: [email protected]. Type 508 Accommodation and the title of the report in the subject line of e-mail.

State Cigarette Excise Taxes --- United States, 2009

Increasing the price of cigarettes can reduce smoking substantially by discouraging initiation among youths and young adults, prompting quit attempts, and reducing average cigarette consumption among those who continue to smoke (1--3). Increasing cigarette excise taxes is one of the most effective tobacco control policies because it directly increases cigarette prices, thereby reducing cigarette use and smoking-related death and disease (1). All states and the District of Columbia (DC) impose an excise tax on cigarettes (1). Because many states increased their cigarette excise taxes in 2009, CDC conducted a survey of these tax increases. For this report, CDC reviewed data contained in a legislative database to identify cigarette excise tax legislation that was enacted during 2009 by the 50 states and DC. During that period, 15 states (including DC), increased their state excise tax on cigarettes, increasing the national mean from $1.18 per pack in 2008 to $1.34 per pack in 2009. However, none of the 15 states dedicated any of the new excise tax revenue by statute to tobacco control. Additionally, for the first time, two states (Connecticut and Rhode Island) had excise tax rates of at least $3.00 per pack. Additional increases in cigarette excise taxes, and dedication of all resulting revenues to tobacco control and prevention programs at levels recommended by CDC, could result in further reductions in smoking and associated morbidity and mortality (2,4).

Cigarettes and other tobacco products are taxed by federal, state, and local governments in various ways, including excise taxes, which typically are levied per pack of 20 cigarettes (1). State cigarette excise tax rates are set by legislation, are contained in state statutes, and usually are collected before the point of sale (i.e., from manufacturers, wholesalers, or distributors), as denoted by a tax stamp. Forty-four states and DC also levy state sales taxes on the retail sale of cigarettes (5).

State cigarette excise tax data for this report were obtained from CDC's State Tobacco Activities Tracking and Evaluation (STATE) system database, which contains tobacco-related epidemiologic and economic data and information on state tobacco-related legislation. Data are collected quarterly from an online legal research database of state laws, analyzed, coded, and transferred into the STATE system. The STATE system contains information on state laws on excise taxes for cigarettes in effect since the fourth quarter of 1995.

All states and DC impose an excise tax on cigarettes (1) (Figure 1). During 2009, cigarette excise tax increases were enacted and took effect in 15 states: Arkansas, Connecticut, Delaware, DC, Florida, Hawaii, Kentucky, Mississippi, New Hampshire, New Jersey, North Carolina, Pennsylvania, Rhode Island, Vermont, and Wisconsin (Table). No state decreased its excise tax. The increases ranged from $0.10 per pack in North Carolina to $1.00 per pack in Connecticut, Florida, and Rhode Island. For states with an excise tax increase in 2009, the mean increase was $0.52 per pack. The increases resulted in Connecticut and Rhode Island becoming the first two states with a cigarette excise tax of at least $3.00 per pack (Table). Additionally, Hawaii included a provision in the state law that will increase the state cigarette excise tax by $0.20 per year in July 2010 and 2011, bringing the state tax to $3.00 per pack.

The national mean cigarette excise tax among all states increased from $1.18 per pack in 2008 to $1.34 per pack in 2009. South Carolina had the lowest state cigarette excise tax in the United States, at $0.07 per pack, and Rhode Island had the highest, at $3.46 per pack (Table). Among major tobacco-growing states (Georgia, Kentucky, North Carolina, South Carolina, Tennessee, and Virginia), the mean state cigarette excise tax was $0.40 per pack on December 31, 2009, an increase from $0.28 in 2008. For all other states, including DC, the mean cigarette excise tax was $1.46 per pack on December 31, 2009, an increase from $1.30 in 2008.

California, Missouri, North Dakota, and South Carolina remain the only states that have not increased their state cigarette excise tax in the past decade. South Carolina's cigarette excise tax of $0.07 per pack has not increased since 1977. Missouri and North Dakota have not raised the state cigarette excise tax ($0.17 and $0.44 per pack, respectively) since 1993, and California has not raised its $0.87 per pack tax since 1998.

Reported by

K Debrot, DrPH, M Tynan, J Francis, MPH, A MacNeil, MPH, Office on Smoking and Health, National Center for Chronic Disease Prevention and Health Promotion, CDC.

Editorial Note

Cigarette excise tax increases reduce tobacco use and initiation. A 10% increase in the price of cigarettes can reduce consumption by nearly 4% among adults (3) and can have an even greater effect among youths and other price-sensitive groups (6,7). When combined with other evidence-based components of comprehensive tobacco control programs, cigarette excise tax increases can be even more effective in reducing tobacco-related death and disease (2). Excise tax increases also can serve as a revenue source to fund and expand state tobacco control programs, further reducing tobacco use and disease (2,4). For example, if every state were to increase its cigarette excise tax by $1.00, even accounting for the resulting decrease in consumption, an estimated $9.1 billion in additional revenue would be generated each year in the United States (8). Additionally, approximately 1 million premature smoking-caused deaths would be prevented, and 2.3 million children would not initiate smoking (8).

Although Kentucky and North Carolina, the two major tobacco-growing states, did increase their cigarette excise taxes in 2009, the cigarette excise taxes in these states remain among the lowest in the country (Figure 1). The individual cigarette excise tax rates in tobacco-growing and bordering southeastern states remain substantially lower than the rest of the country. These states typically have higher smoking rates and do not have strong tobacco control policies, such as comprehensive state smoke-free laws.*

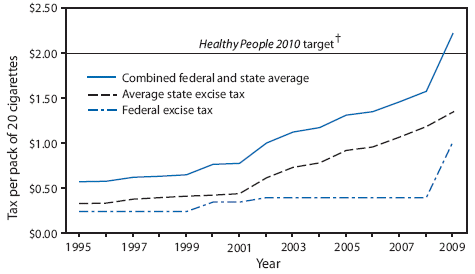

The tax increases described in this report are a part of a general rise in cigarette excise taxes in the United States during the past decade (9). The Institute of Medicine (IOM) noted in 2007 that recent cigarette excise tax increases had largely been in response to state budget shortfalls (2), which also might explain the high number of states that increased their cigarette excise tax rates in 2009. The Healthy People 2010 objective (27-21a)† to increase the combined federal and mean state excise tax to at least $2.00 per pack also was achieved in 2009 (Figure 2) (9). In 2009, the combined federal and mean state cigarette excise tax was $2.35 per pack. This goal was achieved because of an increase in the federal cigarette excise tax, which increased from $0.39 per pack to $1.01 per pack on April 1, 2009. Had the federal cigarette excise tax not taken effect by the end of 2009, the combined taxes would have been $0.27 per pack below the Healthy People 2010 target.

CDC recommends that states invest $9.23--$18.02 per capita on comprehensive tobacco control programs (4), which have been shown to decrease cigarette smoking (2,4). Funding comprehensive tobacco control programs also can reduce health-care expenditures dramatically within a state. In 1988, California established a state tobacco control program funded by a portion of the state's cigarette excise tax revenue (10). In the first 15 years of funding, the $1.8 billion invested in the California tobacco control program resulted in an estimated $86 billion in savings in personal health-care expenditures (10).

The findings in this report are subject to at least one limitation. The STATE system tracks only state-level data and does not include data on local (county, city, or other jurisdiction) taxes. Although not included in this analysis, approximately 460 communities impose a local tax on cigarettes, including New York City ($1.50 per pack) and Chicago-Cook County ($2.68 per pack).¶

IOM recommends that states increase their cigarette excise tax and dedicate a portion of the revenue from these increases to fund comprehensive tobacco control programs at the state-specific level recommended by CDC (2). The more that states spend on tobacco control programs, the greater the reductions in smoking, and the longer states invest in such programs, the greater the effect (4). With fully funded and sustained tobacco control programs complemented with strong tobacco control policies (e.g. cigarette excise tax increases, comprehensive smoke-free policies, and counter-marketing campaigns), IOM's best-case scenario for reducing smoking prevalence in the United States to 10% by 2025 would be attainable (2,4).

Acknowledgments

This report is based, in part, on contributions by M Engstrom, MS, L Zhang, PhD, and T Pechacek, PhD, Office on Smoking and Health, National Center for Chronic Disease Prevention and Health Promotion, CDC; and R Patrick JD, SS Edison, JD, and L Lineberger, MayaTech Corporation, Silver Spring, Maryland.

References

- CDC. Reducing tobacco use: a report of the Surgeon General. Atlanta, GA: US Department of Health and Human Services, CDC; 2000. Available at http://www.cdc.gov/tobacco/data_statistics/sgr/sgr_2000/index.htm. Accessed April 1, 2010.

- Institute of Medicine. Ending the tobacco problem: a blueprint for the nation. Washington, DC: The National Academies Press; 2007. Available at http://books.nap.edu/openbook.php?record_id=11795. Accessed April 2, 2010.

- The Task Force on Community Preventive Services. The guide to community preventive services: what works to promote health? New York, NY: Oxford University Press; 2005. Available at http://www.thecommunityguide.org/tobacco/tobacco.pdf. Accessed April 5, 2010.

- CDC. Best practices for comprehensive tobacco control programs---2007. Atlanta, GA: US Department of Health and Human Services, CDC; 2007. Available at http://www.cdc.gov/tobacco/tobacco_control_programs/stateandcommunity/best_practices. Accessed April 2, 2010.

- Orzechowski W, Walker RC. The tax burden on tobacco, volume 44. Arlington, VA: Orzechowski and Walker; 2009.

- Chaloupka F. Macro-social influences: the effects of prices and tobacco control policies on the demand for tobacco products. Nicotine Tob Res 1999;1(Suppl 1):S105--9.

- Tauras J. Public policy and smoking cessation among young adults in the United States. Health Policy 2004;68:321--32.

- Campaign for Tobacco-Free Kids. Tobacco taxes: a win-win-win for cash-strapped states. Washington, DC: Campaign for Tobacco-Free Kids; 2010. Available at http://tobaccofreekids.org/winwinwin. Accessed April 1, 2010.

- CDC. Federal and state cigarette excise taxes---United States, 1995--2009. MMWR 2009;58:524--7.

- Lightwood JM, Dinno A, Glantz SA. Effect of the California tobacco control program on personal health care expenditures. PLoS Med 2008;5:1214--22. Available at http://www.plosmedicine.org/article/info%3Adoi%2f10.1371%2fjournal.pmed.0050178. Accessed April 2, 2010.

* Data available at http://www.cdc.gov/tobacco/statesystem.

† Available at http://www.healthypeople.gov/document/pdf/volume2/27tobacco.pdf.

¶ Additional information available at http://www.tobaccofreekids.org/research/factsheets/pdf/0267.pdf.

What is already known on this topic?

Increasing cigarette excise taxes is one of the most effective tobacco control policies because it directly increases cigarette prices, thereby reducing cigarette use and smoking-related death and disease.

What is added by this report?

During 2009, 15 states (including the District of Columbia) increased their state cigarette excise taxes; however, none of these states dedicated any of the new revenue to tobacco control.

What are the implications for public health practice?

Dedicating revenues from cigarette excise tax increases to tobacco control programs could complement the effect of excise taxes in discouraging youth smoking initiation, increasing quit attempts, and decreasing the number of cigarettes consumed by those who continue to smoke.

SOURCE: CDC, Office on Smoking and Health. State Tobacco Activities Tracking and Evaluation (STATE) system.

Alternate Text: The figure above shows state excise taxes per pack of 20 cigarettes for the United States as of December 31, 2009. During 2009, all states and the District of Columbia had cigarette excise taxes.

|

TABLE. State excise taxes per pack of 20 cigarettes, amount increased during 2009, and change from 2008, by state --- United States, December 31, 2009* |

|||

|---|---|---|---|

|

State† |

2009 |

Change from 2008 (%) |

|

|

Tax ($) |

Increase ($) |

||

|

Rhode Island |

3.46 |

1.00 |

40.7 |

|

Connecticut |

3.00 |

1.00 |

50.0 |

|

New York |

2.75 |

---§ |

--- |

|

New Jersey |

2.70 |

0.125 |

4.9 |

|

Hawaii |

2.60 |

0.60 |

30.0 |

|

Wisconsin |

2.52 |

0.75 |

42.4 |

|

Massachusetts |

2.51 |

--- |

--- |

|

District of Columbia |

2.50 |

0.50 |

25.0 |

|

Vermont |

2.24 |

0.25 |

12.6 |

|

Washington |

2.025 |

--- |

--- |

|

Alaska |

2.00 |

--- |

--- |

|

Arizona |

2.00 |

--- |

--- |

|

Maine |

2.00 |

--- |

--- |

|

Maryland |

2.00 |

--- |

--- |

|

Michigan |

2.00 |

--- |

--- |

|

New Hampshire |

1.78 |

0.45 |

33.8 |

|

Montana |

1.70 |

--- |

--- |

|

Delaware |

1.60 |

0.45 |

39.1 |

|

Pennsylvania |

1.60 |

0.25 |

18.5 |

|

South Dakota |

1.53 |

--- |

--- |

|

Texas |

1.41 |

--- |

--- |

|

Iowa |

1.36 |

--- |

--- |

|

Florida |

1.339 |

1.00 |

295.0 |

|

Ohio |

1.25 |

--- |

--- |

|

Minnesota |

1.23 |

--- |

--- |

|

Oregon |

1.18 |

--- |

--- |

|

Arkansas |

1.15 |

0.56 |

94.9 |

|

Oklahoma |

1.03 |

--- |

--- |

|

Indiana |

0.995 |

--- |

--- |

|

Illinois |

0.98 |

--- |

--- |

|

New Mexico |

0.91 |

--- |

--- |

|

California |

0.87 |

--- |

--- |

|

Colorado |

0.84 |

--- |

--- |

|

Nevada |

0.80 |

--- |

--- |

|

Kansas |

0.79 |

--- |

--- |

|

Utah |

0.695 |

--- |

--- |

|

Mississippi |

0.68 |

0.50 |

277.8 |

|

Nebraska |

0.64 |

--- |

--- |

|

Tennessee¶ |

0.62 |

--- |

--- |

|

Kentucky¶ |

0.60 |

0.30 |

100.0 |

|

Wyoming |

0.60 |

--- |

--- |

|

Idaho |

0.57 |

--- |

--- |

|

West Virginia |

0.55 |

--- |

--- |

|

North Carolina¶ |

0.45 |

0.10 |

28.6 |

|

North Dakota |

0.44 |

--- |

--- |

|

Alabama |

0.425 |

--- |

--- |

|

Georgia¶ |

0.37 |

--- |

--- |

|

Louisiana |

0.36 |

--- |

--- |

|

Virginia¶ |

0.30 |

--- |

--- |

|

Missouri |

0.17 |

--- |

--- |

|

South Carolina¶ |

0.07 |

--- |

--- |

|

State mean |

1.337 |

0.522** |

64.0** |

|

* Available at http://www.cdc.gov/tobacco/statesystem. † Includes the District of Columbia. § No change during 2009. ¶ Major tobacco-growing state. ** Among states that increased excise taxes in 2009. |

|||

* Includes the District of Columbia.

† The objective (27-21) for 2010 is a combined federal and state average sales tax on cigarettes of at least $2.00. Available at http://www.healthypeople.gov/document/pdf/volume2/27tobacco.pdf.

Alternate Text: The figure above shows federal and state cigarette excise taxes during 1995-2009. The Healthy People 2010 target to increase the combined federal and mean state excise tax to at least $2.00 per pack was achieved in 2009.

Use of trade names and commercial sources is for identification only and does not imply endorsement by the U.S. Department of

Health and Human Services.

References to non-CDC sites on the Internet are

provided as a service to MMWR readers and do not constitute or imply

endorsement of these organizations or their programs by CDC or the U.S.

Department of Health and Human Services. CDC is not responsible for the content

of pages found at these sites. URL addresses listed in MMWR were current as of

the date of publication.

All MMWR HTML versions of articles are electronic conversions from typeset documents.

This conversion might result in character translation or format errors in the HTML version.

Users are referred to the electronic PDF version (http://www.cdc.gov/mmwr)

and/or the original MMWR paper copy for printable versions of official text, figures, and tables.

An original paper copy of this issue can be obtained from the Superintendent of Documents, U.S.

Government Printing Office (GPO), Washington, DC 20402-9371;

telephone: (202) 512-1800. Contact GPO for current prices.

**Questions or messages regarding errors in formatting should be addressed to

[email protected].